Capfin vs RCS Loans: Which Is Cheaper in 2025?

In South Africa, personal loans are a popular way to cover unexpected expenses, consolidate debt, or fund big purchases. Two well-known providers are Capfin and RCS Loans, both offering unsecured personal loans with quick approvals. But when it comes to cost, many borrowers ask: Capfin vs RCS loans – which is cheaper?

This comprehensive comparison breaks down interest rates, fees, loan terms, and total costs based on the latest 2025 data. We’ll help you decide which option could save you money, while emphasizing responsible borrowing.

Related post: Store Accounts You Can Get with a Low Credit Score

What Are Capfin and RCS Loans?

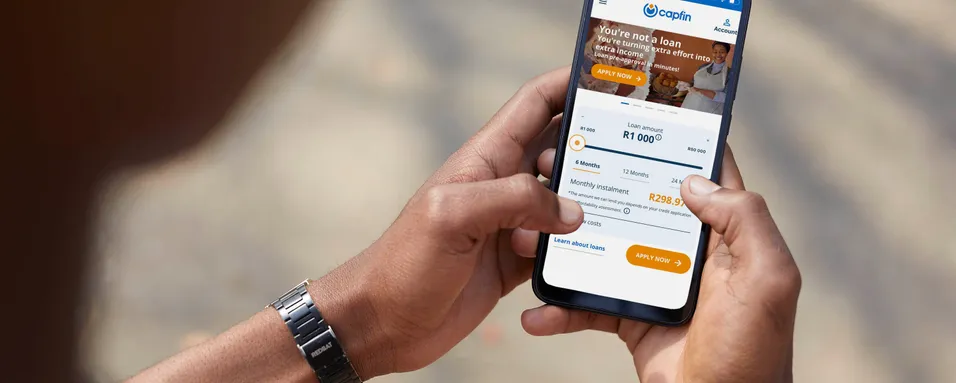

Capfin Loans

Capfin, a subsidiary of Pepkor, specializes in accessible short-term personal loans. Available through PEP and Ackermans stores or online at capfin.co.za.

- Loan amounts: R1,000 to R50,000

- Repayment terms: 6 to 24 months

- Key features: Fixed repayments, quick in-store or online applications, inclusive for varying credit profiles.

RCS Loans

RCS Group (part of BNP Paribas) offers flexible personal loans alongside retail credit cards. Apply online at rcs.co.za.

- Loan amounts: R2,000 to R300,000 (commonly up to R250,000–R300,000)

- Repayment terms: 12 to 60 months (up to 72 in some cases)

- Key features: Larger amounts, longer terms, fixed interest rates.

Both are registered with the National Credit Regulator (NCR) and comply with the National Credit Act (NCA), capping maximum interest at around 27.75%–29.25% p.a. (repo rate + 20% for unsecured loans as of late 2025).

Interest Rates Comparison (2025)

Interest rates are personalized based on your credit score, income, and risk profile. Here’s what official sources show:

| Provider | Minimum Interest Rate | Maximum Interest Rate | Notes |

|---|---|---|---|

| Capfin | As low as 5% p.a. (rare, prime-linked for top profiles) | Up to 27.75% p.a. | Fixed rates; often higher for average borrowers due to short terms. |

| RCS | From 15% p.a. | Up to 27.75%–28.75% p.a. | Fixed; representative examples often cite 27.75%–28.25%. Lower starting rates for good credit. |

- Key insight: Both cap at similar maximums under NCA rules. Good credit (score >670) may secure rates below 20% from either, but RCS examples suggest more competitive mid-range rates.

With South Africa’s repo rate at 6.75% (December 2025), prime lending is around 10.25%. Unsecured loans add a risk premium, pushing rates higher.

Fees and Additional Costs

Both charge similar NCA-regulated fees:

- Initiation fee: R1,000–R1,200+ (e.g., ~R1,207 for R10,000–R20,000 loans)

- Monthly service fee: ~R69

- Credit life insurance: Optional but often included

These add to the total cost, especially on shorter terms.

Which Is Cheaper? Cost Examples

Total cost depends on amount, term, and rate. Longer terms reduce monthly payments but increase total interest.

Example 1: Small Loan (R10,000)

- Capfin (12–24 months at max 27.75%): Total repayable ~R14,000–R17,000 (high due to short term).

- RCS (24–60 months at 27.75%): Total ~R17,000–R20,000+, but lower monthly (~R400–R700 vs Capfin’s higher instalments).

Winner for small loans: Capfin may feel cheaper short-term if you repay fast, but RCS saves if spreading payments.

Example 2: Medium Loan (R50,000)

- Capfin limited to R50k max, short terms → Higher monthly (~R3,000+ at max rate).

- RCS up to R300k, longer terms → More affordable monthly, potentially lower total interest with better rate.

Winner: RCS often cheaper for larger/medium amounts due to flexibility.

Overall:

- RCS is generally cheaper for most borrowers in 2025, thanks to longer terms reducing effective cost and potentially lower personalized rates.

- Short-term needs or smaller amounts? Capfin’s quick access might edge it, but watch high effective rates.

Pros and Cons

| Aspect | Capfin Pros | Capfin Cons | RCS Pros | RCS Cons |

|---|---|---|---|---|

| Loan Size | Easy small loans | Max R50,000 | Up to R300,000 | Min R2,000 |

| Terms | Short & simple | Higher monthly payments | Longer, more flexible | Longer commitment |

| Application | In-store (PEP/Ackermans) or online | Shorter terms increase cost | Fully online, fast payout | May require more docs |

| Cost | Transparent fixed repayments | Often higher effective rate | Potentially lower total interest | Similar max rates |

- Credit score: Higher score = lower rate from both.

- Loan term: Longer = more interest paid overall, but lower monthly.

- Affordability assessment: Both check via NCA – don’t overborrow.

- Current economy: With repo at 6.75%, rates are easing, but unsecured loans remain pricey vs banks (e.g., Capitec/Nedbank from ~11–15%).

Final Verdict: Which Is Cheaper?

RCS Loans are typically cheaper for most South Africans in 2025, especially for loans over R20,000 or when needing flexible repayments. Longer terms spread costs, often resulting in lower total interest despite similar rates.

Related post: How to Open a Business Bank Account Online

Capfin shines for quick, smaller loans (under R50,000) with easy in-store access, but shorter terms can make it more expensive overall.

Recommendation: Get personalized quotes! Use calculators on capfin.co.za or rcs.co.za, or compare via independent sites. Always borrow responsibly – only what you can afford.

Data accurate as of December 2025. Rates/fees subject to change and individual approval. Consult official sites for latest.